Erik Winther Paisley

Business Anthropologist

Providing research, original content, and advisory services

for enterprise clients and the agencies that support them.

Areas of practice

-

When you're making a decision on a merger or acquisition, a new business venture, entering a market, or considering a change to your product stack, services or a rebrand, you'll want to have all the facts. All the pertinent facts, that is.

Not reems of market-level data, topline figures or category trends. This is about you your situation, your pipeline, and your choices..

For the strategic use cases, I offer in-depth profiles of target companies and their leadership, profile the cutsomer customer bases, supply chains and partners to keep you informed.

I've been conducting competitive intelligence projects for the past 11+ years. I'm never wedded to a method, but rely on a classical mixture of open and human sources:Competitor publications, websites, reports, statements in interviews, press releases

Interviews with customers, supply chain and others

Collecting informal feedback and commentary, industry forums, customer feedback, Trustpilot

Distilling recurring themes in coverage from the best-informed consultancies, experts and trade bodies

I also handle tactical briefs - giving specific answers on how competitiors and comparable companies have responded to a specific challenge that you're facing.

-

Whether you’re pitching a project with a research phase or having to manage one, bringing an outside partner can help smooth the process and make sure you get your money's worth.

You just need to decide if you want advice: about vendors, methodology, project designs - or hands-on support to deliver the project.

For long-term recurring projects, you’ll want to work directly with a research agency, but I can help get you to that point. -

Pre-planning research: Making sure you have all the facts and inspiration you need to move from brief to finished product.

Working on the scale of 1-2 days to start a specific creative execution, up to 4 weeks to kick off a multi-channel, multi-product strategy process.

End-to-end support for campaigns

As someone who has worked in-house, in studios and on media buying teams, my instinct is very much not to hit send on a report and log off.

Let's make sure the insights make it out of the set-up slides and into the work itself. -

With high commercial stakes and the internal politics, managing a major change to the brand can be a taxing time for any company.

Bringing in a researcher during those crucial weeks will take pressure off both the team and the wider organisation, so you can focus on making the right call.

-

Topical content and facilitation for offsites, lunch-and-learn meetings, conferences and webinars

Long-term content for e-learning resources, staff training, and onboarding

Advice on how to design and report brand insights in ways that support your real-life ways of working

Key verticals

Tools of the trade

-

Never go into a discussion empty-handed

Get the lay of the land, understand your competitor's recent activities, or create a catalog of ideas and examples from other industries.

Compare creative directions, product names, branding, the tone of voice of copy and messaging, or even in-store designs in a systematic and structured way.

Big picture perspective

Start your strategy off-site with a review of what's been happening in your key regions, suppliers' industries, or media.

Save money by not reinventing the wheel

Almost every topic, product, trade or industry has an army of analysts and commentators producing materials with the potential to answer a question it would cost thousands to run a survey on.

Even a day of dedicated searching and exploration of the available sources can save tremendous time and money by narrowing down the options to something that is cheaper and faster to survey. -

Extensive experience sourcing and engaging experts and key opinion leaders for in-depth, on and off-the-record conversations.

Trade press

Academics

Industry bodies

Current practitioners

Commentators

-

Quantitative survey research

Questionnaire development

Design and scripting

In-house analysis and reporting

Qualitative research

Interview guide development

In-depth interviews

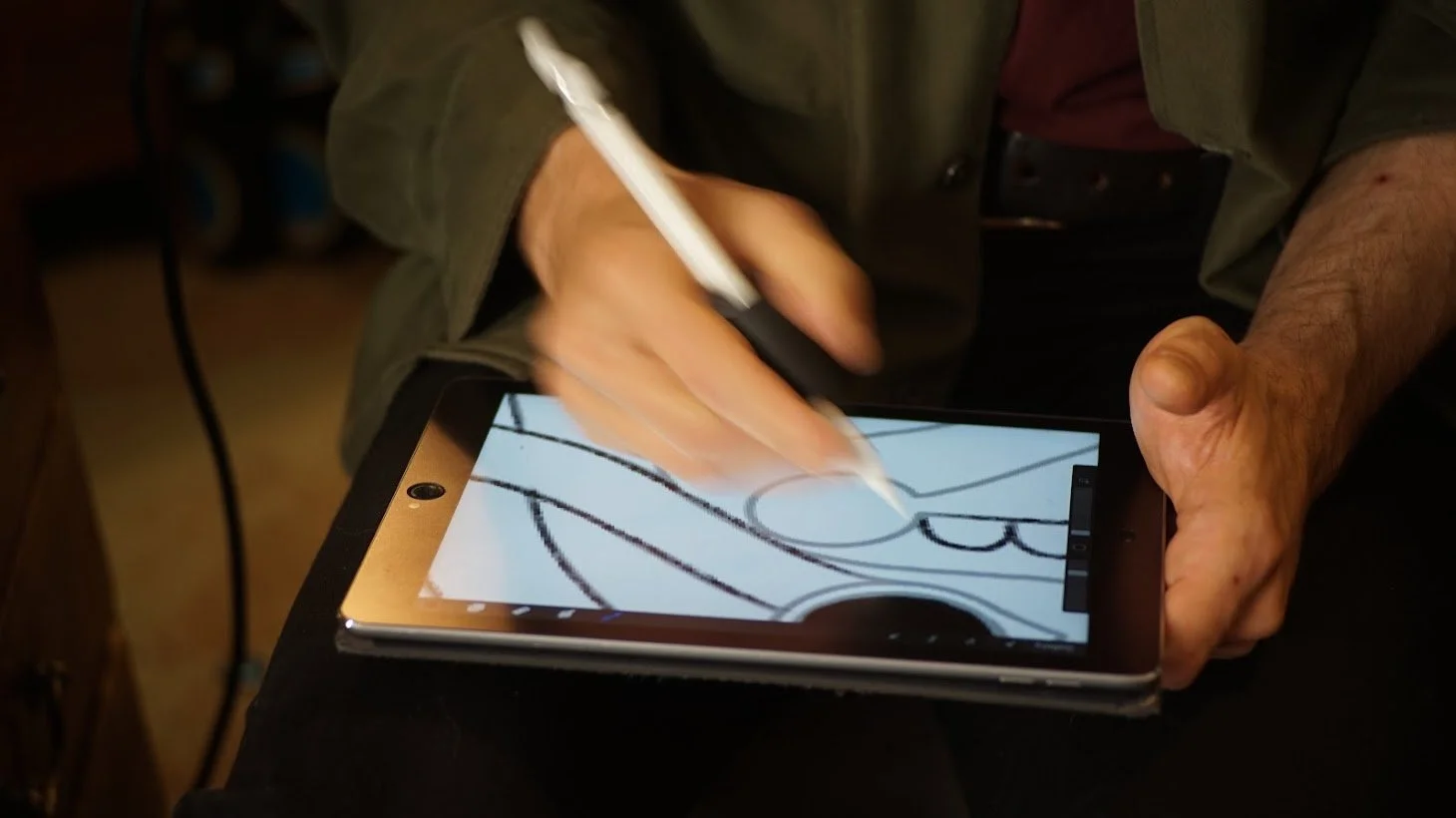

Video and site visits

Ethnographic fieldwork -

Drawing on inputs like:

TGI, GlobalWebindex, Euromonitor, Mintel; Talkwalker and Meltwater; Google Search and Google Analytics; official statistics;

Reporting through

Classic slide decks

Stand-alone visualizations

Dashboards in PowerBI or Tableau -

Custom content

Documentary writing

Onboarding and topical primers

Long-form prose

Webinar scripts

Guest posts

Ghostwriting and coauthorship

Thought leadership content

Articles for trade press

Blog posts

Research editing

Academic papers and theses

Market research reports

Selected clients

Bio

Born 1988 in St. Kitts to Danish and American parents and grew up between the US, Nordics and the Caribbean.

Originally envisioned a career in academia, before a brief stint during grad school with a London media agency convinced me that I wanted a career closer to the action.

Spent much of my teens and 20s volunteering in politics and in various leadership positions, and then became a regular opinion writer for Danish newspapers.

These days, I dedicate a lot time to photography, amassing art supplies, and occassionally some creative writing.

Background

Creative/media agencies

Forpeople

Brand & Deliver

Digitas/Publicis

Neo@Ogilvy/WPP

23red

Havas LuxHub

Havas RE:PURPOSE

Clientside and market research

Advanced Micro Devices

GlobalWebIndex

The Nielsen Company

Credentials

Fellow of the Royal Anthropological Institute

M.Sc. Anthropology from Aarhus University

B.Sc. from University of Copenhagen